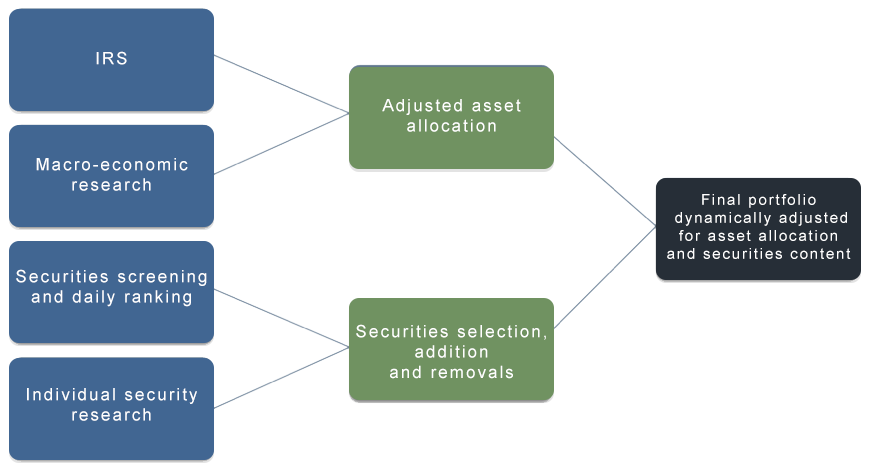

Our investment process

Investment Policy Statement

Macro-economic research

Securities screening and daily ranking

Individual security research

Adjusted asset allocation

Securities selection, addition and removals

Final portfolio dynamically adjusted for asset allocation and securities content

Worth Allaye-Chan Investment Counsel weighs the reward versus the risk for every investment owned. Managing investment risk is just as important as seeking investment return. Along with analyzing securities based on their own merits, we are also aware of the impact of macroeconomics on investment returns. Whether you are an individual or an institution, have $1 million or $50 million, we seek to grow and protext your assets.

- Defines the investment objectives and guidelines applicable to your portfolio

- Reflects your objectives and risk tolerance

- Creates a framework for a diversified asset mix

- Provides transparent disclosure

- Governs investment decisions the portfolio manager will make on a discretionary basis

- Top-down look at economies with short- and long-term outlooks

- Impact on asset allocation – exposure to cash, bonds, stocks – relative to the IPS target allocation

- Impact on sector allocation – exposure to stocks within various sectors

- Impact on fixed income duration – exposure within bonds to credit and term

- Impact on currencies – exposure to non-Canadian dollar denominated investments

- Quantitative analysis of stock universe (factors based investing)

- A factor captures stock characteristics – e.g., value, growth, momentum

- Value factors include valuation multiples – price/earnings, price/book, price/cash flow

- Growth factors include earnings growth, positive earnings revisions, positive earnings surprises

- Identify investment opportunities through analysis of a specific set of factors for each investment mandate – leads to more effective analysis of a broader investment universe

- Disciplined approach to security selection

- Due diligence for confirmation on buy and sell decisions

- Continued monitoring of existing holdings

- Corporate developments that may impact future profitability and/or forward estimates

- Identify risks that might not be captured by quantitative analysis:

- Customer or revenue concentration

- Industry trends and changes

- External factors that may impact future profitability

- Debt covenants

- Supply chain delays

- Corporate governance and management changes

Dynamically adjusted for asset allocation and securities content.